How do animal and plant-based milks affect gut health?

Team Metabolic Health

While both animal and plant-based milks benefit gut health, animal milk shows superior support for beneficial bacteria, raising important questions for dietary choices.

Review: Substitutive Effects of Milk vs. Vegetable Milk on the Human Gut Microbiota and Implications for Human Health

In a recent review published in the journal Nutrients, researchers explored how both animal milk and plant-based milk alternatives affect gut microbiota.

Their findings suggest that while both types of milk can promote gut health, animal milk generally supports a richer and more diverse microbiota, with specific components offering targeted benefits, while plant-based substitutes also contribute positively but may sometimes encourage the growth of harmful bacteria in certain contexts.

Milk and Gut Health

Milk is a vital source of nutrition for mammals, especially during infancy. It provides essential energy and nutrients needed for growth and development. Humans are unique in continuing to consume milk into adulthood.

Milk is known for being high in calcium, vitamins, and proteins, which offer anti-inflammatory benefits. These components have been linked to the prevention of diseases such as cardiovascular issues, osteoporosis, and diabetes.

Despite its many benefits, milk consumption has declined in some regions. This trend is driven by factors such as lactose intolerance, allergies, ethical concerns, and the popularity of plant-based milk alternatives.

These substitutes, made from ingredients like soy, almonds, and oats, are marketed as healthier and more sustainable. However, the research on their impact on gut microbiota remains limited, and the results vary depending on the type of milk and individual factors.

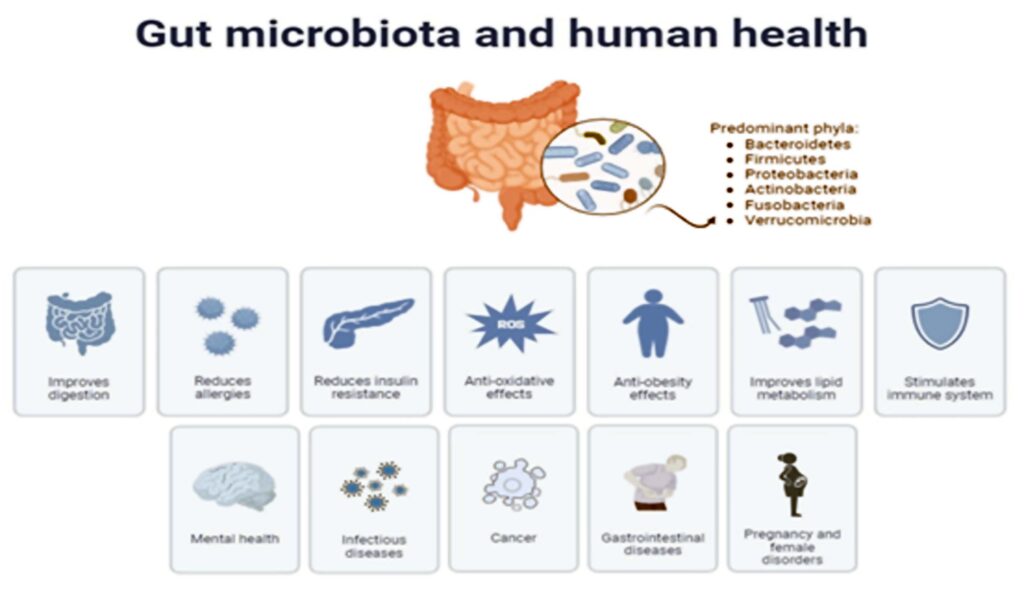

Gut microbiota plays a critical role in overall health, affecting immunity, metabolism, and even brain function. While specific components in animal milk, such as proteins and fats, have been shown to support gut health, plant-based alternatives have also been found to promote the growth of beneficial bacteria. However, some evidence suggests that certain plant-based milk alternatives might, in some cases, foster the growth of less beneficial bacteria, though this typically occurs in low proportions.

Animal-Based Milk

Animal-based milk, particularly from cows, is considered a functional food due to its bioactive molecules, including proteins, fats, and oligosaccharides. These compounds have been shown to have positive effects on gut health.

Mare milk, with its similarities to human milk, is particularly beneficial for individuals with allergies, supporting the growth of beneficial gut microbes while being gentle on the digestive system.

For example, studies have found that animal milk promotes the growth of beneficial bacteria like Lactobacillus and Bifidobacterium. Additionally, components such as whey proteins and lactose support gut health by acting as prebiotics, fostering the growth of beneficial bacteria while potentially offering antimicrobial effects.

Cow milk has been particularly noted for its ability to promote beneficial microbes and reduce harmful bacteria such as Clostridium. Its oligosaccharides, in combination with whey proteins, have been found to increase the production of short-chain fatty acids (SCFAs), which improve gut health by boosting satiety and immune function.

Mare milk, which shares some similarities with human milk, has also been found to support the growth of beneficial gut bacteria. This makes it particularly useful for individuals with allergies or hyperlipidemia.

Goat milk, another animal-based option, contains oligosaccharides that act as prebiotics, increasing SCFA production and improving gut barrier function. It also promotes beneficial bacteria, although in some cases, it has been linked to promoting the growth of Helicobacter, a bacterium associated with gastric issues.

Camel milk, known for its rich immunomodulatory proteins and antibodies, has also shown benefits for gut health. It increases beneficial bacteria while reducing harmful bacteria like Shigella and Escherichia. Its ability to boost SCFA production further enhances its positive impact on gut health and immune responses.

Plant-Based Dairy Alternatives

Plant-based milk alternatives have become increasingly popular due to their perceived health and environmental benefits. These beverages, made from ingredients like soy, almonds, and oats, have distinct nutritional profiles compared to dairy milk.

Generally lower in protein and fat, plant-based alternatives are often rich in unsaturated fats and carbohydrates. They are also free from lactose and cholesterol, making them suitable for those with lactose intolerance or milk protein allergies. In addition, these beverages contain antioxidants and phytosterols, which help reduce oxidative stress in the body.

While plant-based milk can positively impact gut health, promoting the growth of beneficial bacteria, there are some concerns. Soy milk, for instance, has been found to increase beneficial bacteria while reducing harmful ones like Proteobacteria.

However, some studies have shown that certain plant-based milk alternatives might encourage the growth of bacteria such as Fusobacterium and Salmonella, albeit typically in low and manageable levels.

Conclusions

The consumption of plant-based milk substitutes is on the rise globally, particularly in regions like Europe. Although these beverages can replicate some nutrients found in animal milk, significant differences remain in their protein and fat content.

Plant-based milk is also lactose- and cholesterol-free, which makes it suitable for individuals with specific dietary restrictions. While research on their impact on gut microbiota is still emerging, most findings suggest that both animal and plant-based milk can contribute positively to gut health, though with different effects and implications.

The study noted the importance of milk for gut health while highlighting certain points of concern. While animal milk appears to offer greater overall benefits for gut health, plant-based alternatives still provide some positive effects.

It is essential, however, to consider individual nutritional needs and preferences when recommending one type of milk over another, particularly given the variability in gut microbiota responses. Future studies will help clarify how both types of milk impact gut microbiota, ultimately guiding dietary choices based on personal health needs.

Credit: news-medical.net

Health Rounds: Breastfeeding is safe for breast cancer survivors

Team Metabolic Health

Two studies have shown for the first time that breastfeeding after treatment for breast cancer does not increase a woman’s recurrence risk. And, as other studies at the meeting showed, immunotherapy continues to improve hopes for long-term survival for people with various types of cancer.

Breastfeeding found to be safe after breast cancer treatment

Breastfeeding is safe for women who have been treated for breast cancer, two large studies, opens new tab have shown for the first time.

Even cancer survivors at higher genetic risk do not face an increased risk of recurrence or development of new breast cancers if they choose to breastfeed, researchers reported at the European Society of Medical Oncology (ESMO) meeting in Barcelona.

One study of nearly 5,000 young breast cancer survivors carrying a high-risk BRCA gene mutation identified 474 who subsequently gave birth, one in four of whom breastfed their baby. Just under half were unable to breastfeed because both breasts had been removed to reduce future cancer risk. After a median follow-up of seven years from giving birth, there was no difference in the number of breast cancer recurrences, new breast cancers or overall survival in women who breastfed compared to those who did not.

“With this new information, we can debunk the myth that breastfeeding is neither possible nor safe for breast cancer survivors,” Dr. Fedro Alessandro Peccatori of the European Institute of Oncology IRCCS in Milan, who worked on the study, said in a statement. “They can have a normal pregnancy and relationship with their baby, including breastfeeding.”

A second study included 518 women who temporarily interrupted their breast cancer treatment to have a baby. Of those, 317 had at least one baby and 62% of them breastfed. At two years from the first live birth, the proportion of women with breast cancer recurrence or new breast cancer was similar in those who breastfed (3.6%) and those who did not (3.1%).

Other recent studies have shown that neither assisted-reproduction treatments nor pregnancy itself are associated with increased risk of recurrence or new cases of breast cancer.

Immunotherapy improves outcomes in gynecological cancers

Adding Merck’s (MRK.N), opens new tab immunotherapy drug Keytruda to current standard treatments for gynecological cancers can provide meaningful benefits for certain patients, researchers reported at the ESMO 2024 meeting in Barcelona.

In a late-stage trial, opens new tab in women with high-risk locally advanced cervical cancer, adding Keytruda to chemoradiotherapy achieved a three-year overall survival rate of 82.6%, compared to 74.8% in patients who received chemoradiotherapy plus a placebo.

“The benefit in terms of improved overall survival should change our practice as soon as possible,” said Dr. Isabelle Ray-Coquard, president of the Group d’Investigateurs National Evaluation des Cancers de l’Ovaire (GINECO) based in Lyon, France, who was not involved in the research.

“Immunotherapy plus chemoradiotherapy provides a new standard of care for patients with high-risk locally advanced cervical cancer,” Ray-Coquard said in an ESMO statement.

A second late-stage trial, opens new tab in women with newly diagnosed high-risk endometrial cancer found that adding Keytruda to chemotherapy after surgery did not improve disease-free survival for everyone, but it did show a meaningful disease-free survival benefit for patients whose tumors showed a genetic abnormality known as deficient mismatch repair (dMMR).

“Although this trial is not positive in the study population as a whole, it gives us important information indicating that patients with endometrial dMMR tumors are more sensitive and reactive to immunotherapy,” Dr. Elene Mariamidze of the Georgian School of Oncology in Tbilisi, who was not involved in the study, said in the ESMO statement.

Immunotherapy helpful in skin, breast, bladder cancers

Immunotherapy can also prolong survival in patients with advanced melanoma, hard-to-treat breast cancer and advanced bladder cancer, researchers reported at ESMO 2024 in Barcelona.

“The main message from all of these studies is that immunotherapy continues to keep its promise and hope of long-term survival for many patients with different types of cancer,” Dr. Alessandra Curioni-Fontecedro, director of oncology at the Hospital of Fribourg, Switzerland, who was not involved in the study, said in a statement.

In one late-stage trial, opens new tab involving patients with advanced melanoma, half of the participants received immunotherapy with a combination of Opdivo and Yervoy, both from Bristol Myers Squibb (BMY.N), opens new tab. More than half of those were still alive six years later. A good initial response to the treatment – that is, no disease progression for at least three years – predicted a good long-term outcome: 96% of such patients were still alive at 10 years.

“The results from this trial do confirm the potential for cure with immunotherapy in patients with advanced melanoma,” Dr. Marco Donia of the Copenhagen University Hospital Herlev, who was not involved in the research, said in a statement.

“For patients who show no disease progression beyond three years, these longer-term results demonstrate that most of them never progress,” Donia added. “The melanoma-specific survival is very high in this group of patients.”

Immunotherapy also boosted survival in patients with early-stage triple-negative breast cancers, which fail to respond to commonly used breast cancer treatments. Overall survival at five years was 86.6% with Keytruda plus chemotherapy before surgery and continued immunotherapy after surgery, compared to 81.2% with chemo and surgery alone, the study, opens new tab found.

“We had thought that breast cancer may not be sensitive to immunotherapy alone but giving it in combination with chemotherapy before surgery and then further afterwards improves overall survival in many patients,” Curioni-Fontecedro said.

A similar improvement in overall survival with giving immunotherapy before surgery was seen in a late-stage study, opens new tab of patients with muscle-invasive bladder cancer. Patients treated with Astra Zeneca’s (AZN.L), opens new tab Imfinzi plus chemotherapy before radical cystectomy followed by continued Imfinzi had significantly longer event-free survival and overall survival compared to those receiving chemotherapy alone.

Credit: Reuters

The World’s Noisiest Cities Could Ruin A Good Night’s Sleep, A New Study Says

Team Metabolic Health

Hong Kong, Cancun and Las Vegas are the most sleep-disruptive cities, a new study of 30 cities says.

A relaxed vacation can suddenly go awry when city noise interrupts a restful sleep. Hong Kong, according to a new study, is the most sleep-disruptive destination, largely because of high noise levels.

The study, done by Australian mattress company Onebed, determined that Hong Kong also had the highest percentage of negative online reviews concerning sleep quality at its four-star hotels. Thirty cities, including five in the United States, were analyzed in the study and were ranked based on average noise levels in decibels, negative reviews about sleep quality in four-star hotels, air quality data, tourist numbers and nightclub operating hours.

Cancun ranks as the second-most sleep disruptive destination because of high noise levels and the city’s extensive nightlife.

Hong Kong ranks No. 1 as the most sleep-disruptive city, largely because of high noise levels, according to a new study that analyzed 30 cities worldwide. (Photo by Anthony Kwan/Getty Images)

Ranking No. 3, Las Vegas is America’s most sleep-disruptive city, according to the study. More than 40 million annual tourists visit Las Vegas — a larger total than any of the top 10 cities on the sleep-disruptive list. Vegas also has high noise levels and nightlife until 4 a.m., the study says.

Other noisy cities rounding out the top 10 are No. 4 Shanghai, China, followed, consecutively, by Istanbul, Turkey; Marrakech, Morocco; Cairo, Egypt; Amsterdam, the Netherlands; Paris, France, and Rome, Italy.

Of the other U.S. cities included in the 30-city study, New York ranks No. 13. Los Angeles No. 18, San Francisco No. 25 and Orlando No. 26.

Bali, Indonesia, ranks as the best city among the 30 analyzed to get a good night’s sleep without noise disruption. Dubai in the United Arab Emirates and Vienna, Austria, are also good bets for a good night’s sleep, according to the study.

Credit: Forbes

Trendy fruit cuts the risk of heart attack by a fifth, study shows

Team Metabolic Health

The superfood is packed with fibre, healthy fats, magnesium and vitamins C, E, and K

Eating two or more servings of avocado every week reduces the risk of heart disease by a fifth, according to a recent study from the Journal of the American Heart Association (JAMA). The research, which looked at the diets of more than 110,000 people, found eating one of the green fruits a week (the equivalent of two servings) appears to slash the risks of coronary heart disease by 21% compared to people who do not eat avocado.

Aside from being delicious, avocados also contain dietary fibre, healthy monounsaturated fats and other key vitamins and minerals, including magnesium and vitamins C, E, and K. Dr Lorena Pacheco, lead author from the Harvard TH Chan School of Public Health in Boston, US, says: “Our study provides further evidence that the intake of plant-sourced unsaturated fats can improve diet quality and is an important component in cardiovascular disease prevention.”

A woman picking up an avocado from the product aisle at the supermarket

Here are eight ways to get more avocado – without a slice of toast in sight.

1. In your favourite green smoothie bowl

Smoothie bowls may be less trendy now than they were five years ago, but they still remain a popular breakfast option, particularly in the spring and summer. Adding avocado to your blender will help you thicken your bowl, particularly if you also use frozen bananas. Mix blueberries, spinach and raspberries for a sweet and tangy start to the day.

2. As a tasty guacamole

Guacamole has it’s roots in Central America. In Mexico, avocados grow in abundance, and the Aztecs were said to eat it combined with spices. These days, the tasty dip is more often used to top popular Tex Mex dishes like enchiladas and nachos.

However, if made simply and fresh at home (by mashing up ripe avocadoes with garlic, lime, black pepper and chilies) guacamole with tortilla chips or crudités makes an excellent snack and is an easy way to get those vital vitamins in.

3. In a creamy pasta sauce

Yep, a creamy pasta without the cream. Adding avocado to a blender with tasty ingredients like basil, chilli, lemon juice and black pepper, and combining until a creamy sauce will make an easy topping for your pasta of choice. Add a little bit of Grana Padano and you have a quick and healthy midweek meal.

4. In a chocolate mousse

You read that right. Avocado makes a great substitute for eggs in a chocolate mousse – which can make an indulgent pudding vegan. You can’t taste the avocado when it is paired with high cocoa dark chocolate and some of your favourite dairy-free milk. This dessert is a lush final course for a dinner party and can be made in under ten minutes, because it turns out that avocados and blenders go hand in hand.

5. Stuff them

You may be used to stuffing a pepper, a sweet potato or a mushroom, but you can also stuff an avocado. Take out the stone (carefully – apparently injuries from removing them are on the rise), and add couscous, rice, beans, cheese, cooked prawns, whatever you like.

5. In banana muffins

Because it’s high in fat, thick and creamy, avocado is a great addition to a muffin, particularly with banana. It’ll make an excellent breakfast or snack and paired with chocolate chips is a sure-fire hit with kids and grown ups alike. No need for butter and oil, the avocado is doing all the work.

7. Bake them

A great alternative brunch to the usual avocado toast (delicious but becoming rather overdone). Take the stone out of your avocado, crack an egg in the hole, top with cheese or herbs and bake it. This will be delicious with a hollandaise sauce and some sourdough or a zesty Pico de Gallo (Mexican tomato salsa).

8. Drink them

In the 19th century, French colonisers brought the avocado to Thailand and it can be seen on menus now in a very sweet capacity. Sinh Tố Bơ is a cold drink, much like a milkshake, made with condensed milk, coconut milk and ice. It has a beautiful green colour, milkshake-like texture and a nutty taste. The name translates to ‘butter fruit smoothie’ and is a very accurate description.

The bad news is that avocados are on the more expensive end of fruit and veg items. Prices have reported just surged to a 24-year high, a rise that has been put down to inflation pressures and Covid-related supply problems in Mexico, as reported in the Daily Mail.

But if you want to get your hands on them at a slightly lower cost, check out the reduced aisle in your local supermarket for those on the turn (perfect for throwing in a blender).

Credit: mylondon.news

Researchers Uncover New Cardiovascular Risk Factor, Suggest Possible Treatment

Team Metabolic Health

Researchers uncover clonal hematopoiesis as a new cardiovascular risk factor, suggesting colchicine as a possible treatment option.

A significant discovery has emerged in the field of cardiovascular health. Researchers have identified a new risk factor for heart disease that could reshape how we understand and treat atherosclerosis, the build-up of plaques in arteries. This discovery centers on a condition called clonal hematopoiesis, which occurs when certain blood-forming stem cells acquire genetic mutations, leading to their rapid proliferation. Although clonal hematopoiesis has long been associated with blood cancers, it is now being recognized as a key contributor to cardiovascular risk.

What is Clonal Hematopoiesis?

Clonal hematopoiesis refers to the process by which specific blood-forming stem cells acquire mutations in their DNA and begin to multiply at an abnormal rate. These mutated cells, originating in the bone marrow or bloodstream, are not passed down genetically but occur in somatic cells, meaning they arise spontaneously during an individual’s lifetime. As people age, especially in older adults, these mutations can accumulate, and clonal hematopoiesis is often discovered incidentally during routine medical examinations.

In many cases, clonal hematopoiesis does not lead to immediate health problems. However, it has been linked to an increased risk of blood-related disorders, such as leukaemia. Now, researchers are uncovering how this condition also contributes to cardiovascular disease.

Linking Clonal Hematopoiesis to Atherosclerosis

A study published in Nature Medicine in August 2024 revealed clonal hematopoiesis as a new risk factor for atherosclerosis. Atherosclerosis is a condition where plaques build up inside the arteries, leading to blockages that can cause heart attacks and strokes. Traditionally, well-known risk factors for atherosclerosis have included high cholesterol, high blood pressure, diabetes, obesity, smoking, and lack of physical activity. However, this new research shows that clonal hematopoiesis, particularly when associated with mutations in genes like TET2, plays a crucial role in the development of this condition.

Dr José J. Fuster, a leading researcher at the Spanish National Center for Cardiovascular Research, was at the forefront of this study. He explained how clonal hematopoiesis creates a unique population of blood cells with a different genetic makeup from the rest of the body’s blood cells. This altered genetic profile can impair the function of the blood cells, increasing the risk of cardiovascular problems such as heart attacks.

The Direction of Causality: Clonal Hematopoiesis First

Earlier research had raised questions about whether clonal hematopoiesis directly contributed to atherosclerosis or if the reverse was true—that atherosclerosis led to clonal hematopoiesis. However, the Nature Medicine study used longitudinal data from healthy middle-aged individuals to clarify this relationship. According to Dr. Fuster, the findings confirmed that clonal hematopoiesis is a driver of atherosclerosis rather than a consequence of it. Those participants who had mutations linked to clonal hematopoiesis at the beginning of the study were more likely to develop atherosclerosis over time.

Dr Cheng-Han Chen, a cardiologist not involved in the study, reinforced these conclusions. He pointed out that the research shows clonal hematopoiesis increases the risk of atherosclerosis, but the reverse does not hold true. However, he emphasized that further research is necessary to fully understand the mechanisms behind this link.

New Treatment Possibilities with Colchicine

In addition to identifying clonal hematopoiesis as a risk factor for cardiovascular disease, a second study published in the European Heart Journal offered potential treatment strategies for individuals with this condition. This research highlighted the drug colchicine, a medication traditionally used to treat gout and inflammation, as a promising option for people with clonal hematopoiesis who carry mutations in the TET2 gene.

Colchicine is known for its anti-inflammatory properties, which have been harnessed to manage conditions like pericarditis and gout. Researchers now suggest that it could be included in personalized treatment plans to reduce cardiovascular risk in patients with clonal hematopoiesis. Given the role of inflammation in the progression of atherosclerosis, colchicine’s ability to dampen the body’s inflammatory response might slow down or even prevent the development of plaques in arteries.

A New Era in Cardiovascular Care

This discovery of clonal hematopoiesis as a cardiovascular risk factor is a breakthrough that opens up new avenues for both diagnosis and treatment. It also underscores the complex relationship between genetics and cardiovascular disease. While traditional risk factors such as lifestyle choices and metabolic conditions remain critical, understanding genetic mutations like those seen in clonal hematopoiesis could lead to more targeted therapies and earlier interventions.

With further research, clinicians may be able to identify individuals at high risk for atherosclerosis based on the presence of these genetic mutations and tailor treatment plans accordingly. The potential use of colchicine as a preventive measure marks an exciting step forward in addressing this newly recognized cardiovascular risk factor.

In the future, genetic screening for clonal hematopoiesis might become a routine part of cardiovascular risk assessments, helping to prevent heart attacks and strokes in individuals who would otherwise go undiagnosed until it’s too late.

Credit: onlymyhealth.com

‘Rawdogging’ Meals: Does It Help With Weight Loss?

Team Metabolic Health

The new trend of rawdogging — doing something without special preparation or distractions — is now gaining traction in nutrition. An expert says practicing mindful eating can have health benefits, including weight loss.

The term “rawdogging,” which was initially used to describe sex without a condom, is no longer inappropriate in public discourse. Social media users are now promoting “rawdogging flights” that involve using no entertainment, food, or water, while others “raw dog” their exercise routines.

There is no strict definition of “rawdogging,” and it sounds much like good old mindfulness, which is a practice rooted in Buddhism and is the quality of being present and fully engaged with whatever you are doing at the moment.

Now, a dietitian has recently called for rawdogging meals, which refers to eating without being distracted by a smartphone or a TV and focusing on chewing and taste.

However, it is easier said than done, as 24% of Americans report always watching television while eating dinner at home. Another survey found that 15.6% of people in the United States use smartphones or tablets at the table during everyday family dinners. But is it worth trying?

Image by Healthnews

The benefits of mindful eating

Kasey Benavides, a registered dietitian, says eating without distractions has many health benefits, like feeling more satisfied after meals, and plays a role in gut health.

After all, digestion is a top-down process with the first two stops being your mind and your mouth. Mindful eating helps us in both of these areas by first, priming us to be in a more relaxed state before a meal and second, naturally leading us to chew each bite more.

Benavides

There is some evidence suggesting that eating mindfully can help with eating disorders. For example, a 2023 study in women with obesity found that the participants who practiced mindful eating saw greater reductions in uncontrolled and emotional eating compared to those involved in moderate energy restriction.

In women with obesity and binge eating disorder, the eight-week mindful eating program not only improved binge eating episodes and eating habits but also reduced weight, body mass index, and waist circumference. However, more long-term data is needed.

‘Rawdogging meals’ for weight loss

Benavides says mindful eating can lead to weight loss because it helps to pay attention to food, which, as a result, feels more satisfying. Meanwhile, accidental overeating, even if it is just by a few bites, is often enough to plateau weight loss efforts.

“When you pay attention to your food, you’ll not only find yourself enjoying it more, but you’ll also find it’s easier to stop at initial signs of fullness,” she tells Healthnews.

People are especially distracted when eating desserts: they may be focusing on a conversation, a TV show, or feeling guilty about eating it.

Benavides adds, “If you’ve ever found yourself standing over a tray of cookies eating one after the other, try sitting down next time and pay close attention to the exact things about the cookie that you’re loving. Chances are, you’ll feel that satisfaction and find it easier to stop after one.”

How to practice mindful eating

According to the American Heart Association, incorporating these steps into your daily eating routine can help eating mindfully:

Ponder: Check in with yourself about your hunger before you eat — you may actually be thirsty.

Appraisal: Take a moment to take in. How does it smell? Do you really want it?

Slow: Slow down so your brain can keep up with your stomach. Put your fork down between bites and focus on the flavor.

Savor: Take a moment to savor the satisfaction of each bite — the taste, texture, everything.

Stop: Don’t keep eating when you’re full.

Practicing “rawdogging” meals — AKA mindful eating — in a fast-paced environment can be difficult; however, once it is learned, it can help you enjoy food more while losing weight.

Credit: healthnews.com

5 Daily Habits That Help Lower Heart Disease Risk For Women, According To New Research

Team Metabolic Healh

Chances are heart disease doesn’t cross your mind very often. Until you hear that you—or a loved one—are at risk for the disease, it may not factor too much into your day-to-day life.

But heart disease is actually the leading cause of death worldwide1. And for women approaching their 50s, it’s particularly relevant since women who have gone through menopause are more likely to struggle with their heart health than women who haven’t (even if they’re the same age).

Image by Ivan Gener/Stocksy

Low levels of sex hormones (primarily estrogen) during postmenopause are linked to numerous heart disease risk factors like high blood pressure, high cholesterol, and weight gain. But your habits can counter these shifts.

According to new research, postmenopausal women should prioritize five key health factors to lower their heart disease risk.

It’s not just one thing: how a healthy lifestyle can support heart health

Researchers of a new study published in the Journal of the American Heart Association set out to see how these five general lifestyle factors affect the risk for any type of heart disease:

Waist circumference (a way to identify abdominal fat accumulation)

- Cigarette smoking

- Alcohol consumption

- Diet quality

- Leisure-time physical activity

They collected data on each of these factors for over 40,000 women ranging from 50 to 79 years old who had a healthy body weight, had no history of heart disease, and weren’t on menopause hormone therapy. Their lifestyle practices were ranked (individually and collectively) as low risk or high risk for heart disease.

Not surprisingly, having healthier behaviors across the board—like having a smaller waist circumference, not smoking, not drinking in excess, and eating healthfully—were linked to a significantly lower risk of heart disease including strokes and heart attacks.

Why are we so excited about a study that seems to state the obvious?

Well, women as a whole are underrepresented in scientific research, especially when it comes to heart health. So a large-scale study like this that focuses solely on women is a huge win.

And menopause isn’t an overtly known risk factor for heart disease. For women who are entering their postmenopause years (decades really) in good health, this study shows that it is still imperative to prioritize habits that support maintaining a healthy weight. Especially since the physiological changes of menopause may make things like weight and cholesterol management more challenging than before.

How to support your heart health during (and before) menopause

Let’s dive a little deeper into specific recommendations that fall into those five broad categories. (The benefits of not smoking cigarettes are vast and well documented, so we won’t focus on that one now.)

Strength train to build muscle

Undesirable changes (aka the favor of fat storage and muscle loss) in body composition commonly follow the menopause transition. Strength training and actively working to build and maintain muscle is an essential component of metabolic and heart health—which are closely intertwined.

A large study of over 12,000 people (men and women) around 47 years of age found that participating in strength training even once a week or for less than an hour weekly was linked to a 40 to 70% lower likelihood of heart disease—even in the absence of cardio exercise.

While some resistance training is better than none, more is better than some. It’s generally recommended to get two or three days of strength training in a week to work all major muscle groups (like chest, abs, back, legs, etc.).

Focus on fiber

Fiber, especially soluble fiber, plays a vital role in lowering high cholesterol levels. A large analysis of over 22 studies shows that people who eat a lot of fiber have a 20% lower likelihood of developing heart disease5 compared to low-fiber consumers.

But most people aren’t getting the fiber they need. The National Academies recommends that women consume at least 25 grams of fiber daily. So make sure to eat fiber-rich foods like fruits, vegetables, beans, and whole grains, and opt for a high-quality fiber supplement (that can offer up to 7 grams of fiber per serving) if you need extra support. Here are our top fiber picks vetted by a nutrition Ph.D.

Eat more omega-3 fats

Omega-3s are a type of polyunsaturated fat found primarily in seafood like salmon, sardines, anchovies, and herring. Multiple studies show that people who eat fish multiple times a week have half the risk of dying from coronary heart disease and almost a third of the risk of dying from a heart attack as people who don’t eat fish.

Omega-3s support cardiovascular health by promoting healthy levels of fat in the blood6 (triglycerides)and healthy blood pressure levels and fighting inflammation.

But less than 90% of Americans get the weekly recommended servings of fish (a minimum of two 3.5 servings). If you fall into that category, a high-quality fish oil supplement (here are our favorites) can help you get the amount of omega-3s needed for cardiovascular benefits7 (which is generally considered to be at least 1,000 milligrams daily). Here’s our detailed list of the best omega-3 supplements.

Get more quality sleep

Anywhere from 35% to 60% of women in postmenopause8 experience sleep disturbances and conditions like insomnia and sleep apnea8. This is partially attributed to those low sex hormone levels triggering night sweats.

Not getting enough sleep—typically less than six hours a night—and sleeping poorly can greatly increase the risk of coronary heart disease9. Poor sleep can also make weight management more challenging by increasing body fat levels10. Here, we dive into expert-backed ways to help you fall (and stay) asleep.

If you choose to partake, only drink alcohol in moderation

For women, moderate alcohol consumption is considered no more than one drink daily. Occasional drinking is actually linked to improved heart-health outcomes for some11, whereas excessive consumption and binge drinking are associated with poorer heart health.

There’s no reason to add alcohol to your routine if you don’t currently drink. But if you do, consider limiting yourself to the recommended one drink or less per day.

The takeaway

After menopause, women have a higher risk of heart disease and associated risk factors like high cholesterol and excess weight. A new study in the Journal of the American Heart Association reinforces the necessity of taking a holistic approach to preventing chronic disease. While habits like strength training, sleeping well, and eating fiber and omega-3s are important for women at every life stage, they are habits that are worth picking up—even 50+ years into life.

Credit: mindbodygreen.com

Counting calories for weight loss? Gut microbes and digestion also have a key role

Team Metabolic Health

‘Calories in, calories out’ includes what’s eaten and digested as well how those absorbed calories are burned through metabolism.

Is the adage “calories in, calories out” true? The short answer is yes, but the full story is more nuanced.

From the moment food touches your tongue to the time it leaves your body, your digestive system and gut microbiome work to extract its nutrients. Enzymes in your mouth, stomach and small intestine break down food for absorption, while microbes in your large intestine digest the leftovers.

Jannis Brandt via Unsplash

“Calories in, calories out” refers to the concept that weight change is determined by the balance between the calories you consume and calories you expend. This includes not only the number of calories you eat due to appetite and absorb via digestion, but also how well those absorbed calories are burned through metabolism.

Recent research indicates that a significant factor influencing people’s variable appetites, digestion and metabolism are biologically active leftover components of food, known as bioactives. These bioactives play a key role in regulating the body’s metabolic control centres: your brain’s appetite centre, the hypothalamus; your gut’s digestive bioreactor, the microbiome; and your cells’ metabolic powerhouses, the mitochondria.

I’m a gastroenterologist who has spent the past 20 years studying the gut microbiome’s role in metabolic disease. I’ll share how dietary bioactives help to explain why some people can eat more but gain less, and I’ll offer some dietary tools to improve metabolism.

Appetite and digestion

Research has shown that consuming whole foods still “packaged” in their original fibers and polyphenols – the cellular wrappers and colorful compounds in plants that confer many of their health benefits – leads to more calories lost through stool, when compared with processed foods that have been “predigested” by factories into simple carbs, refined fats and additives.

This is one way calorie-free factors influence the “calories in, calories out” equation, which can be beneficial in a society where calorie intake often exceeds needs. Eating more whole foods and less processed foods simply lets you eat more because more of those unprocessed calories go out the other end unused.

Fiber and polyphenols also help regulate your appetite and calorie intake through the brain. Your microbiome transforms these leftover bioactives into metabolites – molecular byproducts of digestion – that naturally decrease your appetite. These metabolites regulate the same gut hormones that first inspired the popular weight loss drugs Wegovy, Ozempic and Mounjaro, controlling appetite through your brain’s satiety center, the hypothalamus.

Processed foods lack these bioactives and are further formulated with salt, sugar, fat and additives to be hyperpalatable, causing you to crave them and eat more.

Mitochondrial maestros

A full accounting of calories also depends on how effectively your body burns them to power your movement, thoughts, immunity and other functions – a process largely orchestrated by your mitochondria.

Healthy people typically have high-capacity mitochondria that easily process calories to fuel cellular functions. People with metabolic diseases have mitochondria that don’t work as well, contributing to bigger appetites, less muscle and increased fat storage.

They also have less of a mitochondria-rich type of fat called brown fat. Rather than storing calories, this fat burns them to produce heat. Less brown fat may help explain why some people with obesity can have lower body temperatures than those who aren’t obese, and why there has been a decline in average body temperature in the US since the industrial revolution.

Healthy mitochondria that burn more calories might also help explain why some people can eat more without gaining weight. But this raises the question: Why do some people have healthier mitochondria than others?

Your mitochondrial health is ultimately influenced by many factors, including those usually associated with overall well-being: regular exercise, adequate sleep, stress management and healthy eating.

Metabolic ‘lights’

The latest nutrition research is revealing the roles that previously underappreciated dietary factors play in mitochondrial health. Beyond the essential macronutrients – fat, protein and carbohydrates – and micronutrients such as vitamins and minerals, other leftover factors in food, including fibers, polyphenols, bioactive fats and fermentation products, are also key for metabolism.

Unlike a Western diet, which often lacks these bioactives, traditional diets such as the Mediterranean and Okinawan diets are rich in foods – nuts, seeds, fruits, vegetables, whole grains and fermented foods – replete with these factors. Many bioactives pass undigested through the small intestine to the large intestine, where the microbiome converts them into activated metabolites. These metabolites are then absorbed, influencing the number of mitochondria in cells and how they function.

At the most fundamental level of cell biology, metabolites turn on and off molecular switches in your genes through a process called epigenetics that can affect both you and your offspring. When the metabolic “lights” are turned on, they enliven the mitochondria responsible for a faster metabolism, effectively increasing the calories you use.

Microbiome gap

A healthy microbiome produces a full range of beneficial metabolites that support calorie-burning brown fat, muscle endurance and metabolic health. But not everyone has a microbiome capable of converting bioactives into their active metabolites.

Long-term consumption of processed foods, low in bioactives and high in salt and additives, can impair the microbiome’s ability to produce the metabolites needed for optimal mitochondrial health. Overuse of antibiotics, high stress and lack of exercise can also adversely affect microbiome and mitochondrial health.

This creates a double nutrition gap: a lack of healthy diet and a deficiency in the microbes to convert its bioactives. As a result, well-studied nutritional approaches such as the Mediterranean diet might be less effective in some people with an impaired microbiome, potentially leading to gastrointestinal symptoms such as diarrhea and negatively affecting metabolic health.

In these cases, nutrition research is exploring the potential health benefits of various low-carb diets that may bypass the need for a healthy microbiome. While the higher protein in these diets can reduce the microbiome’s production of beneficial metabolites, the lower carbs stimulate the body’s production of ketones. One ketone, beta-hydroxybutyrate, may function similarly to the microbiome metabolite butyrate in regulating mitochondria.

Emerging microbiome-targeting approaches might also prove helpful for improving your metabolic health: butyrate and other postbiotics to provide preformed microbiome metabolites, personalized nutrition to tailor your diet to your microbiome, intermittent fasting to help repair your microbiome, and the future possibility of live bacterial therapies to restore microbiome health.

Fat to fuel

For most people, restoring the microbiome through traditional diets such as the Mediterranean diet remains biologically achievable, but it is not always practical due to challenges such as time, cost and taste preferences. In the end, maintaining metabolic health comes back to the deceptively simple healthy lifestyle pillars of exercise, sleep, stress management and nutritious diet.

Some simple tips and tools can nonetheless help make nutritious diet choices easier. Mnemonics such as the 4 F’s of food – fibers, polyphenols, unsaturated fats and ferments – can help you focus on foods that best support your microbiome and mitochondria with “leftovers.” Bioactive-powered calculators and apps can also aid in selecting foods to control your appetite, digestion and metabolism to rebalance your calorie “ins and outs”.

Christopher Damman is Associate Professor of Gastroenterology, School of Medicine, University of Washington.

This article was first published on The Conversation.

19 Major Impacts AI Is Having On The Healthcare Industry

Team Metabolic Health

Artificial intelligence has had a significant impact on the healthcare industry, specifically in the ways businesses and providers operate and deliver care. From streamlining administrative tasks to improving patient care with data-driven insights, there are numerous outcomes that have only become possible with the evolution of AI. Below, the members of Forbes Business Council share their insights and observations about how this technological shift will continue to shape the future of healthcare. Here’s how these experts believe AI will make the industry more efficient, personalized and accessible.

Credit: Getty Images

1. More Time For Providers To Focus On Patient Care

AI improves patient outcomes and the physician shortage. AMA’s three clinical care AI types (assistive, augmentative and autonomous) detect clinically relevant data for physician analysis, quantify it, provide feedback for clinical decisions and offer Dx conclusions and management options. AI performs focused, intensive image and waveform data interpretation, freeing providers for patient care. Anticipate rapid advancements. – Marc Samuels, ADVI Health, LLC

2. Identification Of Clinical And Non-Clinical Patterns In Marginalized Populations

A key impact is AI’s ability to analyze vast datasets to identify clinical and non-clinical patterns, particularly for older adults from historically marginalized populations. For AI to be equitably impactful, it must include inclusive data representation, adhere to robust governance and maintain continuously monitored standards with clear accountability. – Sarita Mohanty, The SCAN Foundation

3. More Efficient Data Collection

Healthcare records are information-rich, yet, too often, data insights go untapped because digitized records and disparate systems make it difficult to collect data efficiently. AI image recognition is already having an impact on diagnostics. Look for expanded insights from decades of healthcare records and medical images in the near future. – Dennis DuFour, TDEC

4. Increased Innovation Velocity

AI is transforming the entire value chain in healthcare. What began with mRNA therapies is now being embraced across the industry, from diagnosis to personalized treatment to FDA approval processes. The usage of synthetic data to increase innovation velocity is perhaps most notable, as it enables a myriad of faster, more efficient use cases all along the value chain. – Jackie Shoback, 1414 Ventures

5. Personalized Patient Care Through Predictive Analytics

One of the most important impacts for businesses in healthcare that AI will bring is personalization within patient care using predictive analytics. AI’s ability to process large amounts of data allows for predictions of the best possible outcomes and treatment regimens, even forewarning on probable health issues before they become critical. These also help decrease costs. – Kamya Elawadhi, Doceree

6. Enhanced Diagnostic Accuracy

AI is profoundly transforming healthcare businesses by enhancing diagnostic accuracy and streamlining patient care processes. Through my experiences in technology and digital transformation, I’ve observed AI’s capability to analyze vast datasets quickly and with precision, which significantly aids in early disease detection and personalized treatment plans. – Sanjay Sehgal, MSys Technologies

7. Better Dental Practice Management And X-Ray Analysis

AI adoption in dentistry is skyrocketing compared to other medical sectors, with practices increasingly utilizing the technology to enhance practice management and analyze dental X-rays for increased diagnostic accuracy. In the future, we can expect AI to become a true standard of care, enabling dental professionals to drive practice growth by streamlining both clinical and operational workflows. – Cindy Roark, Sage Dental

8. Reduced Administrative Burdens

AI has great potential, but we’re aware there is still more to do to make it sustainable within the clinical ecosystem. Immediately, we can see the opportunity to streamline operations and administrative burdens by automating manual tasks. This, in turn, increases the efficiency of our most treasured asset—people—giving clinicians more time to do what they do best, which is caring for patients. – Jeff Surges, RLDatix

9. More Patient Engagement, Even When Physicians Are Unavailable

As physicians, we’re starting to see how AI can improve clinical outcomes. In my practice, we treat obesity, but we can’t be with our patients all the time. Ongoing guidance and motivation are critical for long-term success after a weight loss procedure. We’re piloting the use of an AI-powered weight loss coach that has been shown to help more patients reach their goals through greater engagement. – Christopher McGowan, True You Weight Loss, PLLC

10. Faster Results And More Accessible Care

AI is revolutionizing healthcare by providing faster results. It can analyze vast amounts of data rapidly, identifying patterns and anomalies that might be missed by humans. This leads to earlier detection of diseases, personalized treatment plans and improved patient outcomes. AI could make healthcare more efficient and accessible by transforming patient care and operational workflows. – Chris Coldwell, Quicksilver Software Development Inc.

11. Reduced Versatile Working Time For Medical Staff

There is a shortage of doctors and co-medical staff internationally, and they are always busy. By introducing AI, the versatile working time of doctors and staff will be greatly reduced, which will lead to improved quality of medical operations. In addition, utilizing AI that analyzes the big data of many patients will also lead to the optimization of treatment and services for patients. – Karita Takahisa, UNIFY PLATFORM AG

12. More Precise Analysis Of Medical Images And Patient Data

AI is impacting healthcare through improved and efficient diagnostic accuracy. Machine learning algorithms can analyze medical images and patient data more precisely than humans, leading to earlier detection and personalized treatments. This trend will likely accelerate, which will transform healthcare delivery by enhancing clinical decision-making and enabling more proactive, preventive care approaches. – Aleesha Webb, Pioneer Bank

13. Greater Understanding Of Marketplace Trends

AI is a tool, and like many tools, it can facilitate efficiency (e.g, scheduling), data analysis (e.g., results over time) and our understanding of trends in the marketplace (e.g., access to healthcare in certain areas). That said, I don’t see AI taking over the relational aspects of healthcare, as patients look to their doctors for things AI cannot provide, such as empathy, comfort and support. – Christine S. Ghilain, Brain Health Neuropsychology & Brain Health Consulting

14. Improved Patient Satisfaction

Analytics, diagnostics, scheduling and assistants, among others, are at the forefront of healthcare AI today, but less-socialized applications have the potential to assist with a long-standing struggle: patient satisfaction. AI and chatbots specifically can be used to establish real-time communication with patients still at the facility, enabling service recovery to engage patients when it counts. – Deisell Donahoe, DIOSS LLC

15. Greater Healthcare Access In Remote Communities

Health diagnosis seems like the immediate and big impactful area of need with AI in healthcare. I see its impact in remote areas where specialist doctors are not on call full time. This will revolutionize healthcare, especially in poor communities. – Onyekachi Ginger-Eke, Edutech Global

16. More Personalized Patient Journeys

One of the most important use cases for AI in healthcare is personalizing the patient journey. Patients are looking for answers and guidance, and when you are able to personalize the journey for them, the process is always more impactful than when they feel like a cog in the wheel. – Chad Ramos, Privado Health

17. Deeper Understanding Of Patients

What I get most excited about is how AI has transformed how we analyze treatment plans and deliver care. We gain a deeper understanding of patients through advanced analytics and 24/7 patient monitoring. Health aides have a complete patient profile, factoring in insights not only from their one-on-one interactions but also from the lived experiences of their patients in and out of the healthcare facility. – Josh Klein, Emerest

18. Reduced Care Wait Times

At our company, AI has revolutionized the speed at which we can provide access to speech therapy. By using machine learning technology, we have been able to cut the time to start of care down. We hope to introduce other similar companies to the model, but it is not well understood by those who have not kept up with technology. Once embraced fully, I believe long wait times will be a thing of the past. – Givona Sandiford, Melospeech Inc.

19. Improved Drug Discovery

AI’s impact on healthcare will be pervasive, transforming everything from diagnostics to treatment plans and surgery. AI like AlphaFold 3 will revolutionize drug discovery. We already use large language models to create or summarize medical notes and facilitate interoperability by converting unstructured documents into structured data. The industry will be more efficient, effective and patient-centric. – Johnny Hecker, Consensus Cloud Solutions

Credit: Forbes

Health services aim to tackle Kent obesity rate

Team Metabolic Health

Health services in Kent are teaming up to deliver an action plan to tackle obesity and support those who want to lose weight.

The “majority” of the county’s districts have more overweight and obese adults than the England average, according to a report looking at the issue.

The Kent Weight Management Strategic Action Plan was jointly developed by Kent County Council and NHS Kent and Medway Integrated Care Board.

Meeting documents for Tuesday’s health reform and public health cabinet committee said in 2021-22, 65.8% of adults in Kent were overweight or obese, compared to 63.8% in England.

The report said this was an increase from 63.1% in 2020-2021 and that while the percentage of adults classified as obese increased from 26% in 2020-2021 to 27.3% in 2021-2022, this increase was “statistically significant”.

The districts with the highest overweight and obesity prevalence were Folkestone and Hythe (72.8%), Thanet (72%), Dover (69.4%) and Gravesham (68.3%), according to the report.

Obesity is a significant risk factor for physical and mental health conditions including type 2 diabetes, cardiovascular disease, liver disease, depression and low self-esteem, the report said.

“As a result, there is an increased risk of disability and premature death” for individuals who are overweight or obese, the report continued.

Meanwhile, one programme which has helped people in Kent lose weight is Man v Fat football, where weekly weight loss progress counts towards team goals.

Dan Church, regional manager at Man v Fat, said across Kent participants had lost more than 10,000 kg of weight.

Mr Church said different reasons brought people to Man v Fat, whether people were looking to lose weight, better their mental health or were looking for a social activity.

“Every single guy that we can support to make a lifestyle change and improve their wellbeing is a positive thing,” he said.

Credit: BBC News

Iron deficiency linked to restless sleep in ADHD and autism

Team Metabolic Health

New study links iron deficiency to sleep disorders in children with ADHD and autism: exploring the critical role of iron in sleep regulation.

A recent Nutrients study examines the relationship iron deficiency (ID) and sleep-related disorders.

Iron and sleep/wake disorders

Iron is a trace element present in neurons, astrocytes, oligodendrocytes, and microglia. Iron is also an essential component for both the synthesis of neurotransmitters that regulate the sleep/wake cycle, as well as the dopamine synthesis pathway.

These observations indicate that ID could significantly influence sleep and wake patterns; however, iron levels are rarely considered in the clinical management of sleep/wake disorders.

The most frequent causes of sleep/wake disorders are hyper-arousability, restless leg syndrome (RLS), hyper-motor restlessness, restless sleep disorder (RSD), and periodic limb movements in sleep (PLMS).

Deficiency and Restless Sleep/Wake Behaviors in Neurodevelopmental Disorders and Mental Health Conditions. Image Credit: Dragana Gordic/Shutterstock.com

About the study

Prospective data were obtained between 2021 and 2023 through clinical assessments and structured intake forms. Subsequently, a retrospective analysis was conducted.

Data on the most recent iron status and parental ID history, as well as covariate factors, including comorbidities, demographics, and medications, were recorded. Patients with hematologic comorbidities were excluded. The mean patient age was about 11 years.

Study findings

Of the 250 patients referred to the Sleep/Wake-Behavior clinic in Vancouver, British Columbia, 80% met the inclusion criteria, 188 of whom fulfilled the criteria for non-anemic or anemic ID. A family history of ID was reported in several participants, many of whom indicated that their mothers experienced some form of ID in their teenage years and/or during pregnancy.

Approximately half of the study cohort reported disruptive behaviors, with attention deficit hyperactivity disorder (ADHD) being the most common diagnosis. Anxiety disorder was the most frequently reported internalizing disorder among 84 participants.

Autism spectrum disorder (ASD), global developmental delay/intellectual disability, neurologic conditions, and genetic conditions were the most commonly reported neurodevelopmental presentations.

About 74% of patients exhibited RLS, 52% reported a family history of RLS, and 11% had painful RLS. In 30% of patients, PLMS/restless sleep was noted.

A total of 92 patients had ADHD, among whom the risk of having familial RLS, insomnia, and RLS was significantly increased with a family history of ID. No evidence of an increased risk of painful RLS was observed.

A family history of ID significantly increased the likelihood of having RLS/PLMS/restlessness, insomnia/DIMS, RLS, and familial RLS in a subsample of patients with ASD.

As compared to patients without ID, a family history of ID was associated with a significantly higher risk of RLS. ADHD patients were almost twice as likely to have RLS as compared to patients without ADHD. No association was observed between RLS and ASD, nor bedtime resistance or restlessness, in multivariate logistic regression analyses.

Familial RLS analysis indicated that a family history of ID was associated with a four-fold increased risk of familial RLS as compared to those without a family history of ID. RLS and ADHD were not associated; however, a 70% increased risk of familial RLS was observed in ASD patients. No association was reported between bedtime resistance and restlessness and familial RLS.

Insignificant results were obtained regarding the association between a family history of ID and probable painful RLS. Bedtime resistance or restlessness, ADHD, and ASD were not associated with probable painful RLS.

These findings highlight the need to integrate comprehensive blood work and family history to capture ID in children and adolescents with restless behaviors.”

Strengths and limitations

The high prevalence and family history of ID, coupled with a possible association between ID and self-injurious behaviors, are key strengths of the present study. Nevertheless, there remained a lack of information on the possible causes of ID. Thus, future studies are needed to elucidate the mechanisms involved ID, as this nutrient deficit could be due to multiple factors, such as inflammation or inadequate nutrition.

The current study is a retrospective analysis, which lacks a structured categorization for certain data. For example, no distinction was made between anemic and nonanemic ID in the electronic intake forms, whereas data on mother and father ID was not separated. The statistical power in logistic regression analyses was also reduced due to relatively small sample sizes.

Credit: news-medical.net

Pfizer Drug Helped Cancer Patients Regain Weight, Study Shows

Team Metabolic Health

Cancer cachexia can cause muscle deterioration, weakness

Patients on highest dose of drug regained 5.6% of body weight

Pfizer Inc.’s experimental drug for cancer weight loss was shown to help patients regain weight in a mid-stage study, offering fresh promise for treating the dangerous muscle-wasting condition.

In cancer patients, a syndrome called cachexia causes changes in metabolism and appetite. It can lead to the loss of critical skeletal muscle and fat that weakens the body and, in some cases, can make cancer treatments less effective. Studies suggest that as much as 30% of all cancer deaths are caused by cachexia and about 80% of patients with advanced stage cancers are affected by the condition. There are currently no drugs approved to treat it.

Credit: Bloomberg

Diet is considered to be responsible for around 30% of deaths from cardiovascular disease!

Team Metabolic Health

Nutri-Score hints at foods that increase CVD risk

Cardiovascular diseases are the leading cause of mortality in Western Europe, accounting for 1/3 of deaths in 2019. Diet is thought to be responsible for around 30% of such deaths. Nutrition-related prevention policies therefore constitute a major public health challenge for these diseases.

In an article published in Lancet Regional Health – Europe, researchers from the Nutritional Epidemiology Research Team (CRESS-EREN), with members from Inserm, Inrae, Cnam, Université Sorbonne Paris Nord and Université Paris Cité, in collaboration with researchers from the International Agency for Research on Cancer (WHO-IARC), report an increased risk of cardiovascular diseases associated with the consumption of foods that rank less favourably on the Nutri-Score scale (new 2024 version) within the European cohort EPIC. A total of 345,533 participants from the cohort, spread across 7 European countries and followed for 12 years, were included in the analyses.

These findings confirm the relevance of Nutri-Score as a public health tool to guide consumers in their food choices with the goal of preventing chronic diseases

Mélanie Deschasaux-Tanguy

Officially adopted in France in 2017 (and in 6 other European countries since), the Nutri-Score aims to provide rapid information on the nutritional quality of foods and drinks to help and encourage consumers to compare them and choose those that offer a better nutritional quality. In parallel, it encourages manufacturers to improve the nutritional quality of their products. The Nutri-Score has 5 categories, ranging from A (dark green – higher nutritional quality) to E (dark orange – lower nutritional quality). An algorithm ranks each product according to its levels – per 100 g – of energy, sugars, saturated fatty acids and salt (to limit) and proteins, fruits, vegetables and pulses (to favour).

A number of studies published in international scientific journals have shown the validity of Nutri-Score in characterising the nutritional quality of foods and its efficacy in guiding consumers towards more nutritious choices (over 140 publications). In particular, links between the consumption of foods with a less favourable Nutri-Score (lower nutritional quality) and an increased risk of cardiovascular diseases have so far been observed in French studies (SU.VI.MAX and NutriNet-Santé cohorts). Studies in France, UK, Spain and Italy have also seen similar associations with an increased risk of various chronic diseases as well as higher mortality.

In this new study, the researchers focused on the latest version of the Nutri-Score algorithm, linked to the risk of cardiovascular diseases, in a large population spread across 7 European countries, with the aim of providing new scientific evidence for validating the Nutri-Score on a European scale. It follows two studies on cancer risk published in 2018 and on cancer mortaility published in 2020 in the same population.

A total of 345 533 participants from the EPIC (European Prospective Investigation into Cancer and Nutrition) cohort were included in the analyses. During the follow-up (12 years, between 1992 and 2010), 16 214 participants developed a cardiovascular disease (6 565 of whom had myocardial infarction and 6 245 stroke). The findings show that the participants consuming on average more foods with less favourable Nutri-Score, reflecting lower nutritional quality, were at increased risk of cardiovascular diseases, particularly myocardial infarction and stroke. These associations were significant after a large number of sociodemographic and lifestyle factors were taken into account.

‘These findings confirm the relevance of Nutri-Score as a public health tool to guide consumers in their food choices with the goal of preventing chronic diseases’, emphasises Inserm researcher Mélanie Deschasaux-Tanguy. ‘They also provide key elements to support the adoption of Nutri-Score as a mandatory nutritional logo in Europe’, explains Mathilde Touvier, Inserm research director.

Source: Inserm

Credit: healthcare-in-europe.com

Pregnancy brain changes revealed in detailed scans

Team Metabolic Health

Pregnancy brain really does exist, according to one of the first detailed maps of human-brain changes before, during and after those crucial nine months.

Based on 26 scans of one healthy 38-year-old woman’s brain, scientists found “remarkable things” including changes to regions linked to socialising and emotional processing – some of which were still obvious two years after giving birth.

Further studies in many more women are now needed to determine the potential impact of these brain changes, they say.

And those insights could improve understanding of the earliest signs of conditions such as postnatal depression and pre-eclampsia.

“It’s the first detailed map of the human brain across gestation,” Emily Jacobs, study author and neuroscientist, from the University of California, Santa Barbara, says.

“We’ve never witnessed the brain in a process of metamorphosis like this.

“We are finally able to observe changes to the brain in real time.”

The massive physical changes to the body during pregnancy are well known but much less is understood about how and why the brain changes.

Many women talk about having “pregnancy brain” or “baby brain”, to describe feeling forgetful, absent-minded or having brain fog.

Previous studies have focused on brain scans before and soon after pregnancy, rather than throughout.

The brain studied in the research, published in Nature Neuroscience, is that of scientist Elizabeth Chrastil, from University of California, Irvine’s Center for the Neurobiology of Learning and Memory.

She was planning an IVF (in-vitro fertilisation) pregnancy when the research was being discussed and now has a four-year-old son.

It is “cool” to study her own brain in detail and compare it with those of women who were not pregnant, Dr Chrastil says.

“It certainly is a little strange to see your own brain changing like this – but I also know that to start this line of research needed a neuroscientist to do it,” she says.

In nearly 80% of the regions of Dr Chrastil’s brain, the volume of grey matter – tissue that controls movement, emotions and memory – decreased by about 4%, with only a small rebound after pregnancy.

But there were increases in white-matter integrity – a measure of the health and quality of connections between brain regions – in the first and second trimesters, which returned to normal levels soon after birth.

The changes are similar to those during puberty, the researchers say.

Studies in rodents suggest they could make mothers-to-be more sensitive to smells and prone to grooming and nesting, or homemaking.

“But humans are way more complicated,” Dr Chrastil says.

She did not personally experience any “mommy brain” during her pregnancy but was certainly more tired and emotional in the third trimester, she says.

The next step is to collect detailed brain images from 10 to 20 women and data from a much larger sample at particular timepoints, to capture a wide range of different experiences.

In this way, Dr Chrastil says, “we can determine whether any of these changes could help predict things like postpartum depression or understand how something like pre-eclampsia could affect the brain”.

Credit: BBC News

Coordinated health teams may help improve outcomes for children with Trisomy 21 and heart conditions

Team Metabolic Health

A coordinated, multidisciplinary health care team to address the specific physical, psychological and developmental needs of children with Trisomy 21, or Down syndrome, and congenital heart disease may help children with these conditions lead longer and more productive lives, according to a new scientific statement from the American Heart Association.

The scientific statement, “Trisomy 21 and Congenital Heart Disease: Impact on Health and Functional Outcomes from Birth Through Adolescence,” published today in the Journal of the American Heart Association, an open-access, peer-reviewed journal of the Association.

Statement highlights include:

- Trisomy 21, also known as Down syndrome, is a genetic condition that occurs when a person has an extra copy of chromosome 21. According to the American Heart Association’s 2018 scientific statement on the genetic basis for congenital heart disease, Down syndrome is the most common chromosome abnormality, with approximately 5,300 infants born with Down syndrome in the U.S. each year. About 35-50% of children with Down syndrome are also affected by congenital heart disease.

- Around 70% of congenital heart disease conditions in children with Down syndrome present as some type of atrial septal defect or ventricular septal defect of the heart, often referred to as “a hole in the heart.”

- Pulmonary hypertension and single ventricle heart disease are two known cardiovascular conditions that may reduce life expectancy in individuals with Down syndrome.

- Conditions affecting other body systems, including respiratory, endocrine, gastrointestinal, hematological, neurological and sensory systems, may interact with cardiovascular health concerns and lead to adverse effects for children with congenital heart disease and Down syndrome.

- Improvements in diagnostic, medical and surgical interventions for cardiovascular disease over the past several decades have resulted in greatly improved survival for infants and children with congenital heart disease including those with Down syndrome. Current research on survival in children with congenital heart disease indicates that more than 97% of children with congenital heart disease can be expected to reach adulthood, highlighting the need for multidisciplinary care throughout their lifetime.

- Neurodevelopmental and functional challenges may affect quality of life for children with Down syndrome and congenital heart disease. About 75% of children with these conditions experience feeding and swallowing problems as infants, increasing the risk of malnutrition and failure to thrive, which would affect physical and neurologic development. They also often face lifelong respiratory problems and hypothyroidism (an underactive thyroid; the thyroid produces important hormones that help regulate many functions in the body).

- Vision and hearing impairments (sensory processing disorders) are also common among children with Down syndrome and may impact development of language and communication, as well as cognitive and social behavior skills.

- Psychological conditions, including autism spectrum disorder, attention deficit/hyperactivity disorder, anxiety and depression, are also common in children with Down syndrome as well as children with congenital heart disease.

- Social determinants of health may affect outcomes in children with Down syndrome and congenital heart disease because intellectual limitations and chronic health conditions often contribute to discrimination, bias, inequity, education and socioeconomic status.

- Physical, occupational, speech and behavioral therapies are integral in health care plans for children with Down syndrome and congenital heart disease. Early speech intervention is important to improve communication and autonomy, while physical and occupational therapy are focused on strengthening gross and fine motor skills, increasing independence in activities of daily living, and supporting social skills and sensory integration.

- A comprehensive “medical home” with primary and specialty care that includes a multidisciplinary team of professionals is advised to support care continuity, family-centered care and advocacy. Effective care coordination improves health care access and reduces delays in care, hospitalizations and health care costs. It can also result in enhanced care satisfaction and improvements in overall health outcomes.

- With appropriate support and resources from the multidisciplinary care team, community, school and family, children with Down syndrome and congenital heart disease have opportunities to live fulfilling and productive lives with independence. It is important that the transition to adulthood includes assessment of their needs, skills and decision-making capacity.

- Future research focused on reducing the burden of these conditions is needed to improve functional outcomes and quality of life for children with Down syndrome and congenital heart disease.

The statement was written on behalf of the American Heart Association’s Pediatric Cardiovascular Nursing Committee of the Council on Cardiovascular and Stroke Nursing, the Council on Clinical Cardiology, the Council on Genomic and Precision Medicine, and the Council on Cardiovascular Radiology and Intervention. American Heart Association scientific statements promote greater awareness about cardiovascular diseases and help facilitate informed health care decisions. Scientific statements outline what is currently known about a topic and what areas need additional research. While scientific statements inform the development of guidelines, they do not make treatment recommendations.

Credit: news-medical.net