After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. Find the best trucking accounting software for your business with our comparison guide. Read about features, pricing, and more to make the best decision for your company. These typically have a maturity period of one year or less, are bought and sold on a public stock exchange, and can usually be sold within three months on the market. Examples include common stock, treasury bills, and commercial paper. Finally, if stock picking is not for you, you could try investing in ETFs or in futures markets.

Quick Ratio Formula

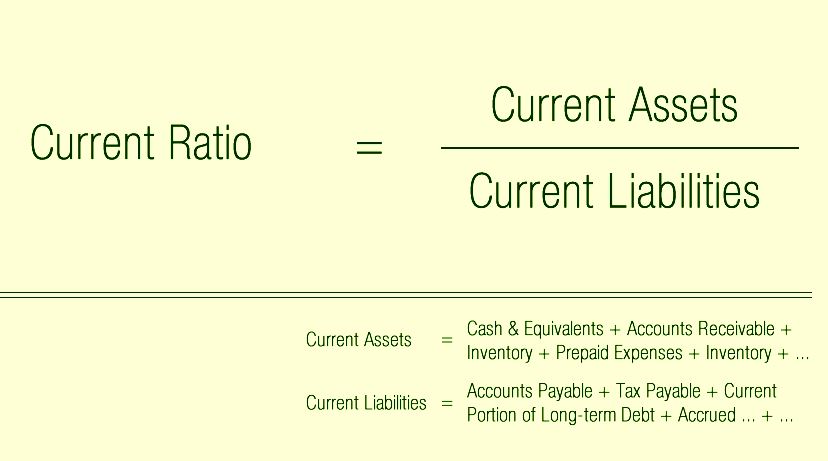

Putting the above together, the total current assets and total current liabilities each add up to $125m, so the current ratio is 1.0x as expected. The current ratio measures a company’s ability to pay current, or short-term, liabilities (debts and payables) with its current, or short-term, assets, such as cash, inventory, and receivables. The cash ratio measures your company’s ability to cover short-term obligations using only cash and cash equivalents.

Current ratio vs. quick ratio vs. debt-to-equity

The quick ratio, often referred to as the acid-test ratio, includes only assets that can be converted to cash within 90 days or less. If it’s growing, that can tell investors and traders that the company’s current assets are growing. The above analysis reveals that the two companies might actually have different liquidity positions even if both have the same current ratio number. While determining a company’s real short-term debt paying ability, an analyst should therefore not only focus on the current ratio figure but also consider the composition of current assets.

Ask a Financial Professional Any Question

This article and related content is provided on an” as is” basis. Sage makes no representations or warranties of any kind, express or implied, about the completeness or accuracy of this article and related content. Modern financial technology (such as Sage Intacct) boosts the speed and accuracy of quick ratio analysis, supporting agile financial management. A company that has a quick ratio of more than one is usually considered less of a financial risk than a company that has a quick ratio of less than one. A 2019 research study (revised 2020) called “Day Trading for a Living? ” observed 19,646 Brazilian futures contract traders who started day trading from 2013 to 2015, and recorded two years of their trading activity.

- Since the business has such an excellent ratio already, Frank can take on at least an additional $15,000 in loans to fund the expansion without sacrificing liquidity.

- The current ratio reflects a company’s capacity to pay off all its short-term obligations, under the hypothetical scenario that short-term obligations are due right now.

- The current ones mean they can become cash or be paid in less than a year, respectively.

- More importantly, it’s critical to understand what areas of a company’s financials the ratios are excluding or including to understand what the ratio is telling you.

A high current ratio, on the other hand, may indicate inefficient use of assets, or a company that’s hanging on to excess cash instead of reinvesting it in growing the business. The simple intuition that stands behind the current ratio is that the company’s ability to fulfill its obligations depends on the value of its current assets. Therefore, applicable to all measures of liquidity, solvency, and default risk, further financial due diligence is necessary to understand the real financial health of our hypothetical company. The current liabilities of Company A and Company B are also very different.

Current Ratio: How to Calculate and Analyze It + Examples

The value of current assets in the restaurant’s balance sheet is $40,000, and the current liabilities are $200,000. It can include patents, production equipment, inventories, etc. The current ones mean they can become cash or be paid in less than a year, respectively. The current ratio calculator is a simple tool that allows you to calculate the value of the current ratio, which is used to measure the liquidity of a company.

Other similar liquidity ratios can supplement a current ratio analysis. The current ratio is called current because, unlike some other liquidity ratios, it incorporates all current assets and current liabilities. The current ratio is sometimes called the working capital ratio.

Short-term solvency refers to the ability of a business to pay its short-term obligations when they become due. Short term obligations (also known as current liabilities) are the liabilities payable within a short period of time, usually one year. A Current Ratio greater than 1 indicates that a company has more assets than liabilities in the short the 8 best accounting software for 2021 term, which is generally considered a healthy financial position. It suggests that the company can comfortably cover its current obligations. If a company has $500,000 in current assets and $250,000 in current liabilities, its Current Ratio is 2 ($500,000 / $250,000), indicating that it has twice the assets to cover its immediate obligations.

Here, we’ll go over how to calculate the current ratio and how it compares to some other financial ratios. Learn how to build, read, and use financial statements for your business so you can make more informed decisions. The ideal current ratio is proportional to the operating cycle. Companies with shorter operating cycles, such as retail stores, can survive with a lower current ratio than, say for example, a ship-building company.